Cards And Payments

ATM Card

Provides you easy access to ATMs for your daily banking needs

An ATM card is a payment card or dedicated payment which enables a customer to access automated teller machines (ATMs) or other channels. Usage is subject to available funds in cardholder’s Savings or Current Account. When the cardholder makes transaction on ATM/POS, the amount is deducted directly from their Savings or Current Account with CPBank Bank.

With the inclusion of Cambodian Shared Switch network (CSS), our ATM cards can be used to withdraw money nationwide at any CSS member’s ATMs. The ATM cardholder needs only to look for the CSS logo on the ATM machines to identify CSS member ATMs.

Features

- Withdraw cash from our growing network of ATMs here in Phnom Penh and in the provinces No collateral or minimum deposit balance required

- Personalized – your name is printed on your ATM Card.

- No application/approval fee

Annual fee

- FREE

* Terms & Conditions apply.: www.cambodiapostbank.com.kh/T&C

Debit Card

Allows you easy access to your funds here and abroad

With the Visa logo, your CPBank’s Debit card is instantly recognized here and abroad. If you want to get instant access to your funds and enjoy convenient payments without worrying about interests and late payment charges, CPBank debit card is your right choice.

Features

- Withdraw cash from our growing network of ATMs here in Phnom Penh and in the provinces No collateral or minimum deposit balance required

- Personalized – your name is printed on your ATM Card.

- No application/approval fee

Annual fee

- FREE

* Terms & Conditions apply.: www.cambodiapostbank.com.kh/T&C

Visa Credit Card

Making payment/ purchase without cash

CPBank credit card is the best choice to improve your lifestyle with an easy way of making payments at any time and anywhere.

Features and Benefits

- Immediate alert message on the transaction

- Real-Time Repayment/top-up for credit balance

- Card Transactions (Cash withdrawal, E-commerce, International Transaction, Purchase) can be manage via Mobile App (turn on/off)

- Flexible monthly payment methods

- Convenient and quick cash advance at ATMs wherever VISA card is accepted

- Eligible all promotions sponsored by Visa & CPBank

- Free access Plaza Premium Lounge around the world up to 6 times per year.

- Lounge locations

Fees and Charges

| Services Description | Fees & Payment |

| Application Fee, Approval Fee | Free |

| Dispute Fee | Free |

| Card Replacement Fee | USD3/Card |

| Overdue Date (late payment) Fee | USD20 |

| Statement Date | 28th of the month |

| Direct Debit Date | 10th of the month |

| Payment Grace Period | From statement date -12th of the month |

| Payment Channel | 1. Direct Debit; 2. CPBank MB; 3. ATM/CDM Machine; 4. Counters; 5. Third partner |

| Cash Withdrawal via CPBank’s ATM (per transaction fee) | Min USD3 or 2% whichever amount is higher than USD150 |

| Cash Withdrawal via other bank’s ATM (per transaction fee) | Min USD5 or 2% whichever amount is higher than USD250 |

| Annual Service Fee | USD12 Silver Card; USD25 Gold Card |

| Credit Card Interest Rate P.A | Credit Purchase 18%P.A; Cash Advance 24%P.A |

| Direct Debit | Min USD20 or 5% whichever is higher |

Documents Requirement

- Valid identifications

- Proof of income

- Proof of resident

Credit Card Criteria

- Applicant’s Age: 18 – 70 Years Old

- Stable income from salary / business

* Terms & Conditions apply.: www.cambodiapostbank.com.kh/T&C

What is Virtual Card?

CPBank Virtual Card is a card that can use to purchase online the same as a Visa card, but you can create a virtual card by yourself on your mobile phone up to $ 2,500 and can increase your amount.

After you create a virtual card, you can use to purchase on the popular online websites such as Amazon, Google Play, App Store, eBay, Air Asia, Expedia, Alibaba.com, Taobao.com, Agoda, Booking.com, Netflix, Ali Express, Food panda, Nham24, BLOC Food delivery,…

Why do we need to use Virtual Card?

- For customers who do not have a visa card yet

- For customers who do not want to spend time to access any branch for applying for visa card

- No need to wait for Visa card from 01 to 02 weeks

- Protect your Visa card from being hacked by hackers

Benefits of Virtual Card

- No create and annual fee

- Instantly, issuance with instantly purchase

- Security online payment

- Purchase online by only using your mobile phone

- Can limit your daily purchase

- Check all your transactions via CPBank Mobile Banking

Terms and Fees

| Currency | USD |

| Type of Card | VISA |

| Daily Purchase Limit | USD 1 – 2,500 per Virtual Card |

| Create Fee | Free |

| Monthly or Yearly Free | Free |

| Number of Active Virtual Cards | 10 active cards per CPBank Mobile Banking |

| Validity Period | 1 month – 5 years |

| Interest rate | N/A |

| Daily Purchase Count | No limit |

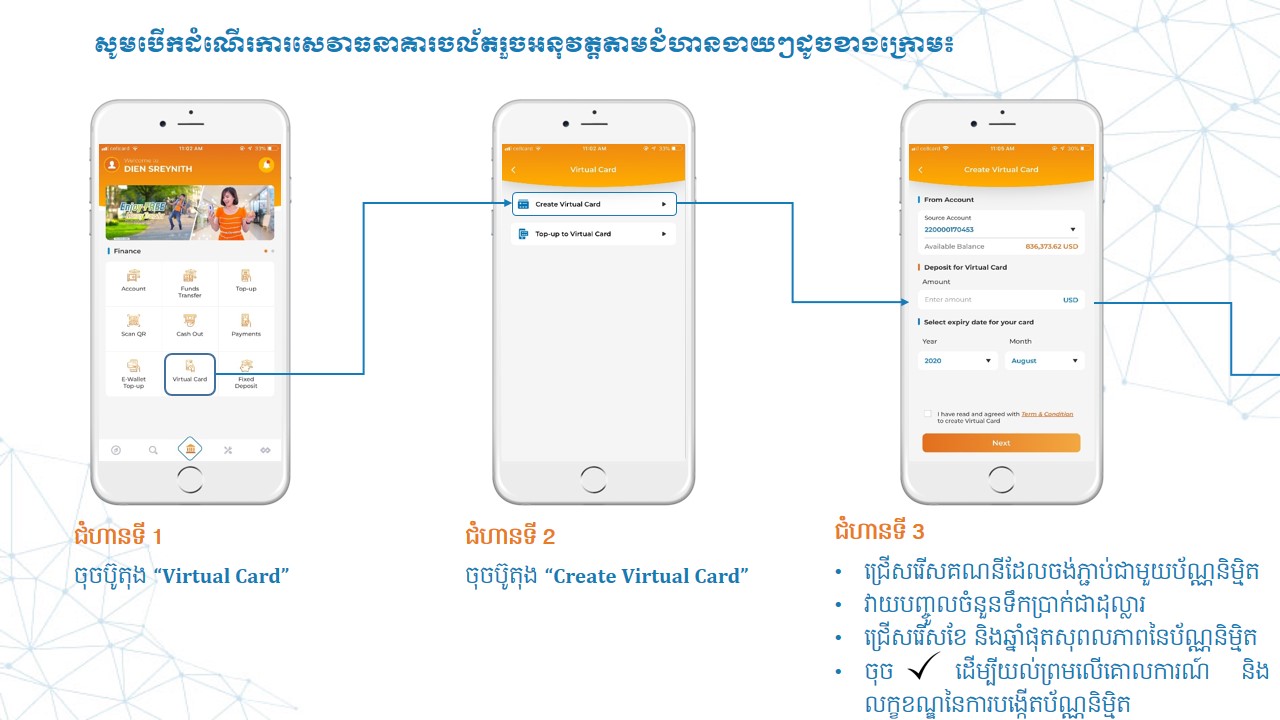

How to create Virtual Card?

CPBank KHQR

Making digital transactions easy

With CPBank’s KHQR, you can accept cashless payments made from banks and financial institutions which are member of NBC’s Bakong system. Improve your business experience with CPBank KHQR!